Infusystems ($INFU) released Fourth Quarter 2015 and Full Year 2015 earnings today which were very good. The company has executed very well over the past 3 years and momentum is really building in terms of revenue growth and earnings growth. I wanted to cover some of my thoughts about the 2015 10-K, conference call, and news release. I’ve been invested in $INFU for a few years now, and I believe the business is still on the right track to keep growing and producing cash flow for the foreseeable future. Highlights for the full year 2015: Revenue of $72.1m...

Turnaround Stock Stories – Turn Back Time – Marvel Enterprises $MVL

I thought that I would look back at some of my past investments, before I started my blog and before I began to journal the investment thesis for purchases I make, and document some of my reasons for the purchase, and the outcome. Of course I’m working on an outcome bias here, but I think it’s worth writing out some history lessons that I should keep in mind as I look for future businesses to invest in the future. The first look back will be one of the best investment returns I have made by investing in Marvel Enterprises...

Is a Brand a successful Moat or Barrier to Entry?

I’ve decided in the past, that a company’s brand was a strong enough moat to keep competitors at bay, and allow the company to keep earning profits This has been a grave error, and warrants further study. I’ve since learned that a brand, by itself, is not a strong competitive advantage resulting in a defensible economic moat. For a strong moat a stronger situation needs to be in place such as some kind of customer preference, distribution or network effect that is the source of a strong competitive advantage. Companies spend a lot of money on marketing and advertising to build...

The Sleuth Investor Book Review

The Sleuth Investor by Avner Mandelman is a different kind of investment book than most other financial books which cover more traditional aspects of investing. This book focuses squarely on what a small investor (or firm) should be doing in order to gain an advantage against the rest of the market. As the title depicts, the advantage investors with a smaller capital base can gain is by physically “sleuthing” the target investment company. Because many analysts and larger investment firms do not do much physical investigation, one can theoretically gain an advantage by doing the more difficult work. The...

Critical Look at using DCF for Valuations

Professor Damodaran has written a ton of articles about Discounted Cash Flow (DCF) analysis over the years. I don’t think another website has as much information about valuation and DCF as on his blog – so it is a wonderful resource to visit and use for investors. His latest blog post on DCF which defends the use of DCF as a valuation technique is a good topic. Many investors have discredited the use of the DCF technique and Damodaran tries to initially cover some of these myths and focus on the critical use of DCF in valuing companies. It...

Size Matters, if You Control Your Junk

This is a new research paper published on January 22nd 2015 that studies the return of stocks based upon the size (defined in multiple ways). What was done differently than other studies, was that the authors used a Quality and Junk variable to apply to the data. The result was that smaller firms outperformed larger firms in the stock market if the portfolio was controlled with the QMJ (Quality Minus Junk) factor. Meaning that a lot of the smaller companies were “junk” but the ones that were of quality outperformed the market. The Authors: Clifford S. Asness – AQR Capital...

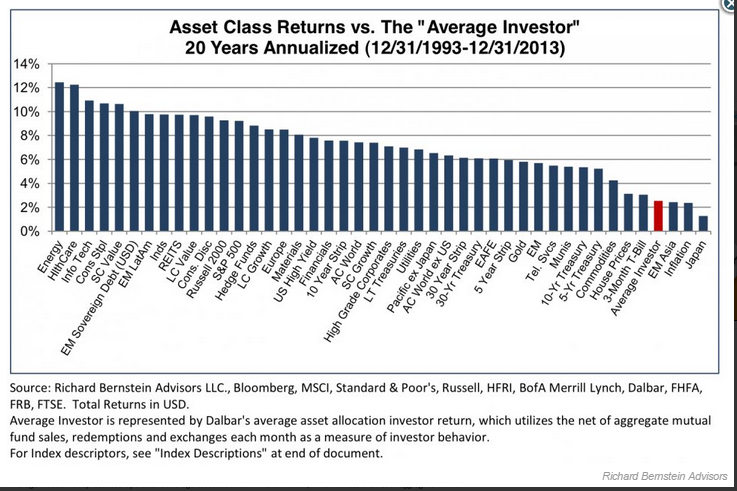

The Average Investor is Terrible at Stock Picking

Thanks to The Big Picture and Value Walk for bringing this chart to my attention that was included in a recent Seth Klarman note. Asset Class Returns vs the Average Investor I’m not sure what most investors are doing with their investments, but it isn’t pretty. In the above chart, it displays the annualized return over the past twenty years by asset class. Farthest left is Energy which average just over 12% return per year for 20 years, and all the way to the right is Japan with a dismal 20 year return. But look at where the...

Questions about Bitcoin that I Would Like to See Discussed

I’ve been interested in Bitcoin and the underlying technology for the past couple of years, and have tried to learn as much as possible about the technology and its potential use cases. There is a lot of hype surrounding Bitcoin and the Blockchain, but I do not think many people posses enough knowledge about the technology. I don’t claim to be an expert, but I’ve been trying to keep up with the technology, the current arguments as to why Bitcoin/Blockchain are important and finally what impact it will have on the future of money, currency, finance, trade, insurance, contracts, legal,...