I tend to tweet and retweet articles online throughout the week that I think are of interest. You can follow me on Twitter if you would like. I’m also going to try and write a quick weekly recap of articles and stories that I read for the week that I think are of interest to others. I’ll try and write a little recap as to why I think it’s important, and sometimes I may actually write a separate blog post if I have more to say. I know that there are a million + 1 blogs that have...

The Basics of Understanding Financial Statements Book Review

The Basics of Understanding Financial Statements Book Review The Basics of Understanding Financial Statements: Learn How to Read Financial Statements by Understanding the Balance Sheet, the Income Statement, and Cash Flow Statement by Mariusz Skonieczny This is a pretty simple book, and covers the basics of the three financial statements that investors use to determine the quality and value of a business. The target audience of this book is definitely a novice in understanding financial statements. Most of the information can be easily found online on various websites, but it is nice to have everything combined into a single...

Company Turnarounds are Hard

Our conclusion is that, with few exceptions, when a management with a reputation for brilliance tackles a business with a reputation for poor fundamental economics, it is the reputation of the business that remains intact – Warren Buffett Turnarounds seldom turn. – Warren Buffett I’ll admit that I am interested in finding companies that are in a turnaround. I feel that if I can locate a company that will be successful, it will result in a high return on my investment. However, if you are experienced in the markets, or have worked for a company that is in...

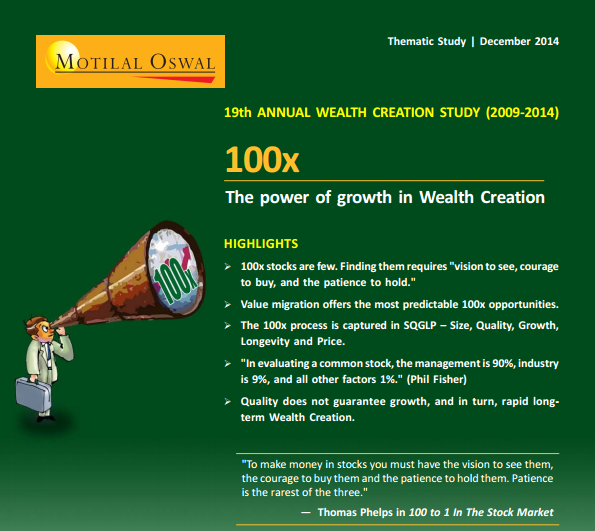

100x The Power of Growth in Wealth Creation

Thanks to Ian Cassel from MicroCapClub for tweeting out a link to a paper produced by Motilal Oswal which is a study on companies that have gone on to become 100 baggers within that past 5 years. A 100 bagger is a company whose share prices as increased 100 times the initial price, or in other words, the company has experienced tremendous growth that has translated into tremendous share price gains. A really great paper analyzing 100-baggers H/T @Anil_Tulsiram http://t.co/Qcoj5cq7Rx Wish someone would do this here in the US #investing — MicroCapClub (@iancassel) December 16, 2014 100x The...

Smart Links from February 9th 2014

Word Science of Social Media is an infographic created by ShortStack which analyses the titles for highest social media sharing. The infographic is broken down by Twitter, Facebook and Blog and displays the words in title that get that most shares. A good read if you want to increase your social media shares. Value Investing goes Back to the Future discusses the apparent change in thinking of value investors (according to Barron’s Conway). In recent years value investors were concerned with bankruptcy risk and book values but it appears that might have changed to forward-looking metrics like p/e ratios....

Critical Change within Value Investing?

Last month Barron’s published an article by Brendan Conway named Value Investing goes Back to the Future. In the piece, Conway goes on to try to establish the premise that value investors have changed from using historical prices or backward-looking measures to more risky forward earnings or forward-looking measures. What exactly is value investing? Value investors buy attractively priced stocks, but there are backward-looking measures, as well as forward-looking ones. Lately, the forward measures are winning, and that fact tells an interesting story about what’s driving investors. When value investors start to use forward-looking measures, I immediately begin to...

5 Links to read for January 20th 2014

How Momentum Investors Create Narrowing Breadth – As momentum plays run out, investors pile into a smaller pool of stocks thus creating a narrowing breadth of options until no more options are available. No Silver Bullets in Investing – By James Moniter thanks for PMJar.com – A single silver bullet option is not available in investing no matter how much investors try to find it. How To Create Your Own Cryptocurrency – Have you thought about how to create your own Bitcoin? Well, it’s really not hard to create a new cryptocurrency, but it’s much more difficult to make it successful....

Are Markets Efficient? – Comments by Howard Marks

Howard Marks’ latest memo is a good read and discusses two very interesting topics 1) Role of luck in investing and 2) Are market efficient? I’m not going to cover the role of luck in investing in this post, but I do believe luck plays a role and luck happens to people who position themselves to take advantage of it. Market Efficiency The theory of efficient markets makes sense, as the more freely and quickly information flows, the market can incorporate that information instantaneously always providing “accurate” pricing using the latest information. However, humans still play a role in the...